A host of economic concerns are shaking marketers’ confidence, according to the latest research. How are they navigating the post-Covid environment?

How will marketing fare if the economy plunges? It is a perennial question for marketing leaders and one that has reared its head once again in late 2022. The latest round of The CMO Survey shows that marketers’ economic optimism is dwindling as US companies confront escalating inflation, ongoing supply-chain challenges, job market uncertainty and the threat of recession. There is an increasing possibility that marketing budgets will start to shrink and prices for customers will rise. Here are some of the key findings from this year’s survey.

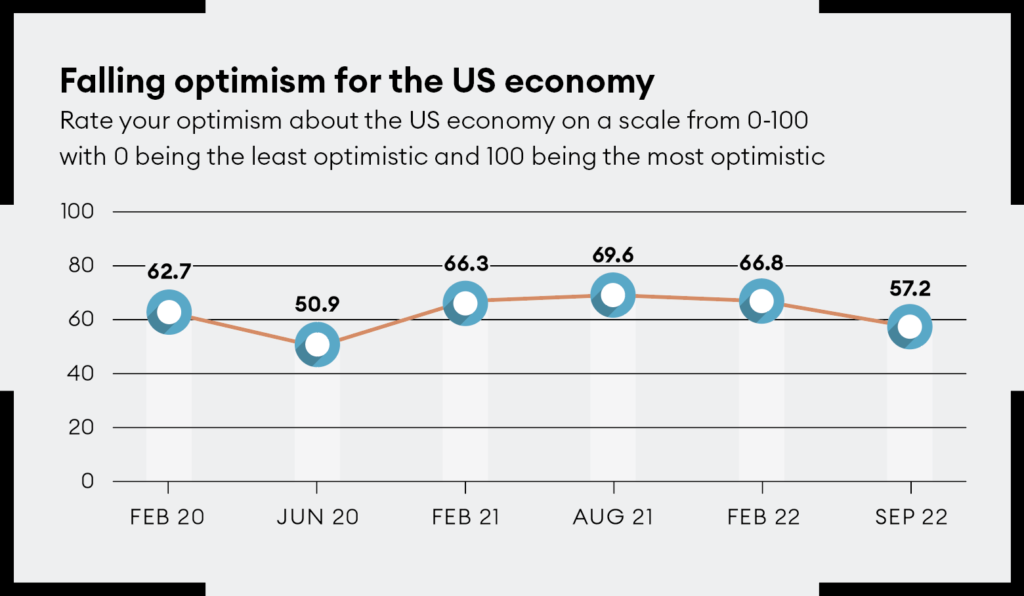

Economic optimism is falling as uncertainty rises

As economic uncertainties have multiplied, the high levels of economic optimism recorded early in 2022 have faded. In February 2022, The CMO Survey recorded an optimism score of 66.8 out of 100: six months on, that number has dropped to 57.2. Despite the drop, the score remains well above the 50.9 recorded at the height of the pandemic in June 2020, and the all-time low of 47.7 in February 2009, during the Great Recession. The most optimistic sectors are healthcare (62.6) and manufacturing (62.3), while the least sanguine are banking/finance/insurance (45.9) and consumer services (46.3) – likely due to fears of a recession, and the response to consumers shifting away from reliance on online services.

Marketing budgets are bigger than ever

Marketers accelerated their investments in digital marketing investments during the pandemic. That has pushed marketing budgets up to an average of 13.8% of overall company budgets – the highest level since The CMO Survey began. Marketers report 10.1% growth in marketing spending over the last year but predict that will decrease to 8.8%.

Inflation is having an increasing impact

Inflationary pressures are decreasing marketing spending levels for many companies (42.3%), although almost as many (41%) note neither an increase nor decrease. Looking ahead, a majority (65%) believe inflation is likely to result in increased prices for customers. Forty per cent of marketing leaders report their companies are focusing on improving their value proposition. Only 13% report making layoffs to date, pointing to a continuation of tight labor market conditions.

Marketers are using more channels than ever

In the wake of the pandemic, a majority of marketers (65.1%) are using a larger number of channels, including using social channels to sell (41.4% overall – rising to 61% among B2C Product businesses). Surprisingly, only 10.5% of marketers report that their former face-to-face channels are now all digital, while 50% report that they are returning to or opening up face-to-face channels.

Customers are prioritizing quality, service and low prices

Before the pandemic, marketers told us that their customers’ top priority was trusting relationships. That shifted during the pandemic, with superior product quality coming to the fore: 30% identify it as their customers’ top priority, followed by excellent service (18.7%). But marketers also now highlight the importance of low price, which is ranked as the priority by 17.2%. It is another indication of increasing inflationary pressures.

Work from home remains prevalent

Work from home arrangements are now commonplace: 57.5% of marketers report their teams working from home at least some of the time, and 48.7% working from home all of the time. Overall, marketing leaders are confident about team productivity in both arrangements, with 50% reporting no change in worker productivity levels. However, more than a third report that working from home has weakened company culture, and many worry that the socialization of young colleagues has suffered.

More firms are prepared to take a stand

The percentage of marketing leaders who report that their companies would use their brands to take a stance on politically-charged issues reached an all-time high at 30.2% of companies, up from the pre-Covid level of 18.5%. B2B service companies are the group most willing to take a stand at 37%; among specific sectors, technology (46.5%) and professional services (45.5%) businesses stand out. Companies that make more than 10% of sales through the internet were more willing to have a voice on charged issues: among firms where online accounts for 50-99% of sales, more than half are willing to engage on politically-charged issues.

Marketers are increasing spending on DEI

Marketers reported a 10.7% increase in their diversity, equity and inclusion (DEI) spend – a level consistent with results since August 2021. However, when we ask what types of impact marketers have been able to document, the overall averages are weak (below the midpoint on a 7-point scale, where 7 = a great deal and 1 = not at all). The most common indicators of impact are employee retention (a score of 3.9) and employee attraction (3.7). Respondents report their marketing organizations comprise, on average, 57.1% female, 22.1% non-white, and 2.3% disabled members.

Investment in analytics is up

Spending on marketing analytics as a percentage of the marketing budget hit an all-time high of 8.9% after a decade-long level of 6%-7%. The trend is expected to continue over the next three years to reach 14.5%. Marketing analytics is now being used in nearly half of all marketing decisions, rising from 37.7% just before the pandemic – and companies have also made a good deal of progress in tracking the contribution from marketing analytics to company performance.

The pandemic may be over, but its after-effects are still being felt across the US economy. We are entering what could be an extended period of uncertainty. With marketing budgets under pressure, it will be crucial for marketers to demonstrate the value they add to their businesses – including through enhanced analytics – and focus on activities that deliver real value to their organizations.

The CMO Survey has been collecting and disseminating the opinions of marketing leaders since 2008 in order to predict the future of markets, track marketing excellence and improve the value of marketing in organizations and society. Conducted twice yearly, the survey is sponsored by Duke University’s Fuqua School of Business, Deloitte LLP and the American Marketing Association. Fieldwork for the 29th round of the Survey was conducted in July-August 2022 among 273 marketing leaders at for-profit US firms. Complete reports, including industry benchmarks, can be found at https://cmosurvey.org/results