Professor Christine Moorman of Duke’s Fuqua School of Business has developed the first industry-wide survey of marketing data.

The Fuqua School of Business’s Professor Christine Moorman is a pioneer. She launched her marketing survey in 2007 – it claims to be the longest-running non-commercial survey of its kind. Its findings and analysis are freely available. It’s certainly an excellent source of data on what’s on the minds of chief marketing officers (CMO), the challenges and opportunities faced by the marketing function and where it’s headed. Partners in this work are the American Marketing Association, the Fuqua School of Business at Duke University and McKinsey.

I asked Professor Moorman why she started the survey in the first place. “It was born of two frustrations,” she reveals. “One was that marketing was not yet ‘at the table’ and two that the field lacked good data to understand marketing effectiveness. I wanted to offer a mechanism to the field that would solve both problems. I carried out the first CMO survey in 2007 and from 2008 have established it as a biannual event.”

It’s probably true to say that in 2007, people still thought that marketing was mostly about advertising spend or how to push-sell products and services. In reality, marketing expertise is really about customers – gaining deep insight into their current and future needs and desires. Many agree that customer needs should drive an organization and the phrase ‘customer-centricity’ is still in vogue. After all, business is set up to provide value to customers, and customers provide cash or value to the company in return. Moorman’s complaint that “marketing was not yet at the table” expresses her desire that marketing should be tackled at a strategic, rather than an operational, level.

The second issue Moorman hoped to address was the dearth of good-quality marketing data. It’s a bit like measuring the return on investment (ROI) from training programmes. It’s actually fairly straightforward if you start by working out what you want the training to achieve, setting up some metrics and tracking these systematically over time. Like any other data, the results need a good dose of applied common sense, like avoiding double-counting and understanding other variables that also may affect the outcomes. But approached in the right way, it’s possible. The same logic can be applied to any investment, including that in marketing. If you set measurement goals up front and try some marketing experiments, you can then assess the effectiveness of each.

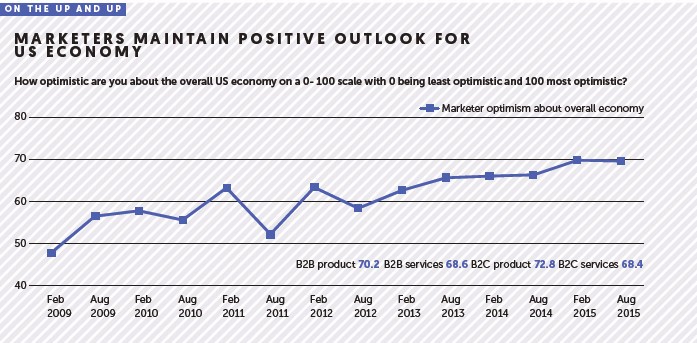

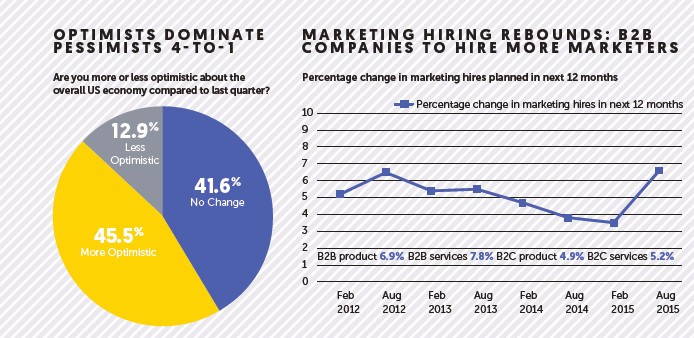

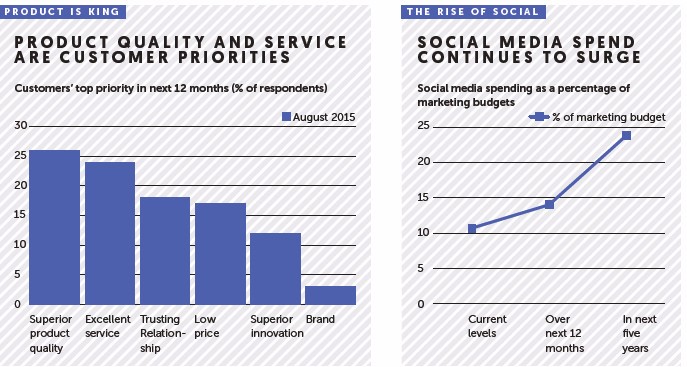

Like any strategic function, it’s about planning – looking ahead rather than backwards – and innovation. Moorman is trying to plug at least part of the data gap through systematically and regularly capturing information from CMOs, thus providing the function with role models and benchmarks. To that end, the CMO survey captures forward-looking measures in addition to historic spend and marketing budgets. Moorman designed the survey to focus on a set of critical topics that would be addressed in each survey – such as growth spending, marketing leadership, marketing organization, performance metrics, and marketing leaders’ views about the economy. Early on in the survey, she added segments on social media and marketing analytics that have captured critical spending benchmarks, plus the organizational context for such activities. Culture eats strategy for breakfast, and Moorman notes that organizational context can often be why such new marketing activities underperform.

Social media: The new frontier

As the August 2015 CMO survey results (see below) clearly demonstrate, companies know they must invest in social media marketing initiatives, but they are struggling to assess the value they are gaining from their investment.

“This situation is similar to the way advertising was perceived post-1950s,” says Moorman. “Back then, the challenge was whether to work with external agencies or develop the capability in-house. Then, as now, working with an external agency means that you have access to world-class specialist expertise and can fast-track your efforts. But at the same time, the agency will have its own agenda, such as being creative and winning awards, which may or may not be compatible with your company’s aims. So unless you can fully integrate the external agency, you may be working at cross-purposes. And, of course, you also have to divulge a lot of potentially sensitive company information if your chosen provider is to be effective in supporting you.”

The challenge of how to handle social media seems to have some parallels. If you outsource activity to a supplier, the initiative risks being disconnected from broader marketing efforts. On the other hand, it takes time and investment to build social media capability from scratch, whereas social media third-party suppliers are expert and can advance you fast along the learning curve. It will be interesting to see how this challenge is resolved over the coming years.

There are some role models out there for other companies to look to and follow. For example, Moorman points to PepsiCo as one company that has taken the bold step of working towards building the talent in-house rather than simply working with external agencies. She notes: “A critical step is finding and nurturing the right type of talent – talent that can handle complexity, look for points of integration, and think outside the box. Not all companies are in a position to take this step. External agencies offer critical support to many companies as they begin this process, or over the long run as they build strategic partnerships with these agencies.”

The marketing challenge: Some ideas to try

Moorman puts forward a couple of ideas that companies could try, to help them improve their marketing game, based on her recent survey results.

First, she notes: “Marketers need to lead more externally facing areas of the firm. With marketing leading innovation in only 36% of companies, there is a missed opportunity here for marketing to contribute. Marketing leaders need to step up to these responsibilities and build a case for them to lead these activities. Second, marketing leaders need to build their impact through a strong organizational base – a base that has a focus on customers, which is marketing’s critical currency.” According to the 2015 CMO survey, 29% of companies are organized around customer groups.

Moorman would like to see more companies moving in this direction in order to ensure companies are serving an array of customers’ needs and improving the overall customer experience – not focusing solely on the sale of current brands. Finally, Moorman believes that marketing analytics is a significant opportunity for marketing to bring greater rigour to its decisions. “This will take a powerful combination of managerial context, statistical inference and customer insight,” notes Moorman. “Any one of these without the others is unlikely to improve marketing’s contributions.”

An adapted version of this article appeared on the Dialogue Review website.