What ESG can (and cannot) do for people and our planet.

About a year ago, I had a conversation with a senior executive at a major consumer goods company in the United States. She shared a story with me about a call she had received from her company’s chief executive a few months earlier. The CEO had been speaking with a group of investors. They were happy with the company’s financial performance, but wondered what the company was doing about ESG. After fumbling around trying to answer the question for the investors, the chief executive called my friend and asked her, somewhat sheepishly: “So what is our ESG strategy anyway?”

As it happens, my friend didn’t know the answer. In fact, she began googling ‘ESG’ on her computer while her boss was still talking, to get some hints on what the term meant. Yet after that call – and a few more conversations – my friend was appointed the chief ESG officer for the firm.

Almost overnight, these three letters – standing for environment, social and governance – have captured the imagination of companies and business leaders, investors, employees, politicians, and even the general public. The meteoric rise of ESG has also created a powerful backlash from many critics. It is the right moment to step back and ask some basic questions. What do we mean by ESG? What are its limits? And what could it be?

Business and society: a short history of a contested relationship

The emergence of ESG is only the most recent moment in a long-running debate about the relationship between business and society. In the 1600s the world’s first modern corporation, the British East India Company, was created by government charter to “visit, haunt, trade, traffic or adventure” in the East Indies (Rupali Mishra, A Business of State, 2018). As the company grew wealthier and more powerful, it extended into new regions and industries, but also levied taxes and assembled a standing army.

The more the East India Company operated like a state overseas, the more resistance it spurred back home. In the mid-1800s, the British government dissolved the company and nationalized its assets. It made plain the risks facing a business that overstepped its mandate and competed with the government for power.

More recently, many of us can remember the ‘greed is good’ era, when companies were expected to be as profitable as possible, constrained only by local laws and regulations, and were discouraged from getting involved in complicated social issues. Companies maximized shareholder returns. As a result, many shareholders did become wealthier. But this approach didn’t always work out so well: remember the heroes of capitalism like Enron who crumbled overnight because of governance failures? They showed us that companies that didn’t understand their broader societal role could ultimately be a threat to our societies and economies.

By the 2000s, the conversation shifted again. Yes, shareholder returns were still primary, but companies faced growing calls to address mounting social and environmental challenges. For a company to be responsible or sustainable, long-term profits must be balanced with the needs and priorities of their employees, local communities, business partners and supply chains. This was the ‘triple bottom line’ era, when stakeholders and sustainability were bolted on to the core priorities of the firm – usually voluntarily, rather than by government mandate.

A partner in solutions

I knew this world well. In the early 2000s, I took a position with Coca-Cola’s think tank in New York. Our mandate was to identify emerging issues that could impact the company in the coming decades. What we discovered is that water quantity and quality would likely be Coca-Cola’s most important – and most disruptive – future challenge. For the company to survive, it would need to transform its relationship with its primary ingredient, water. What would it do if water sources for 1,000 bottling plants in nearly every country on Earth failed?

In response to that challenge, we created an ambitious water stewardship strategy, and spent the next five years pursuing the daunting task of embedding the stewardship approach across a complex global business system. We aspired to shift the company from being part of the world’s water problem to being a partner in the solution.

I am proud of our work at Coca-Cola in the early days of the sustainable business era. We recognized the stakes of a growing global water crisis and found ways to align company interests with those of society. This work has become a template for many other companies to address social and environmental risks to their business.

But what we know today is that this isn’t enough. The effects of climate change become more destructive every day. Clean water becomes more scarce, massive gyres of plastic pollution swirl in the oceans, and social and racial injustice continues to fester – even as corporate profits soar. In the wake of these ‘wicked problems’, we know we need something much more ambitious, more rigorous, more transformative.

We need a grand reset.

Why ESG is different

The need for a grand reset becomes more apparent every day, as we experience a cascade of profound disruptions in our ecosystems and societies. Climate futurist Alex Steffen urges us to “snap forward” – for our thinking to catch up with the scope, scale and speed of the problems we face (see alexsteffen.substack.com). The world has changed but we don’t know how to describe the new terrain, let alone navigate it. We need an approach that relies less on altruism and more on real incentives and penalties. We need to create real prosperity without sacrificing people and planet.

Enter ESG. Less than a decade in circulation, a different paradigm for managing environmental, social and governance issues has largely subsumed the earlier frameworks for corporate responsibility and sustainability. It differs from those ideas in some important ways.

ESG is driven by an alliance of investors and activists

Investors increasingly recognize their enormous influence over the companies in their portfolios and have begun to demand that companies align with their priorities. This has transformed the market. Bloomberg recently forecast that ESG assets may surpass $50 trillion by 2025, one-third of the total assets under management globally. Activists recognize their overlapping interests with investors and realize that decarbonization and related challenges will not be cheap. Massive amounts of capital will be needed, soon, for a rapid global transition.

ESG creates a common management platform

ESG extends the evaluation of corporate performance to a much broader range of criteria. It goes beyond discrete strategies for specific issues and creates a common management platform for widely diverse interfaces between business and society. ESG enables stakeholders to evaluate the strengths and weaknesses of a company across many domains, and promises to allow comparison of firms within and across industries.

ESG establishes clear metrics and standards

There are multiple frameworks for ESG-related performance and reporting. It remains to be seen whether these disparate groups, representing different geographies and interests, can agree on common approaches, but standardization is essential for ESG’s long-term success.

Why now?

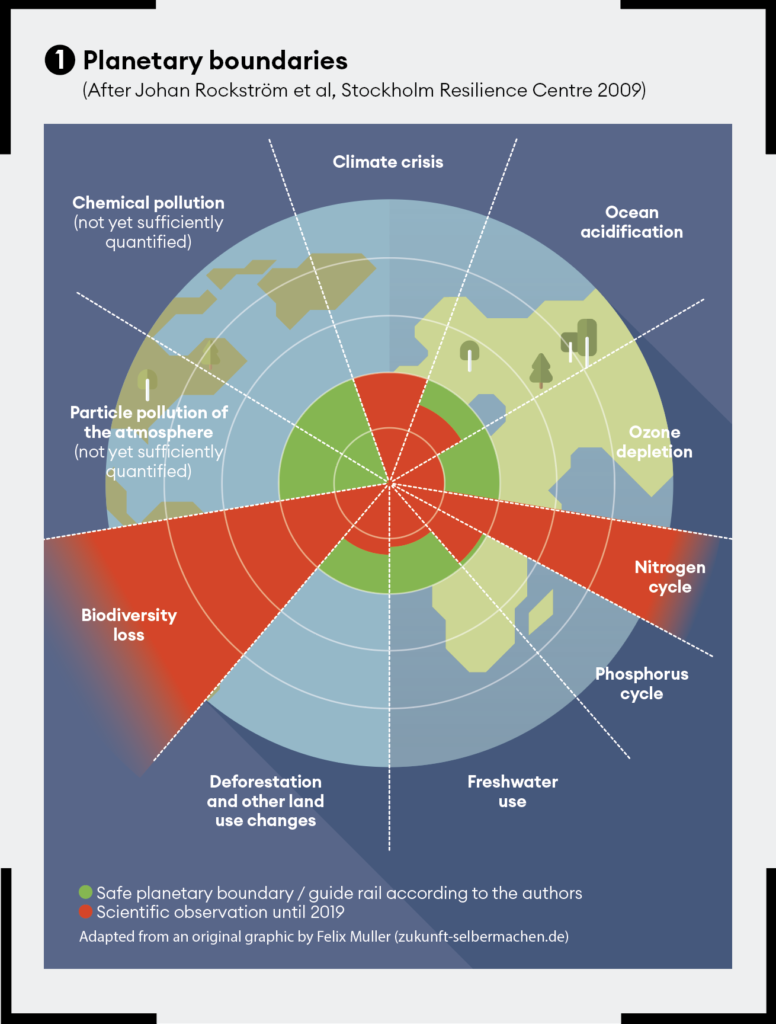

There are three main reasons why ESG has come to the fore now. First, ESG can be a tool for engaging the private sector more substantively in responding to the planetary crises that emerge daily. Climate change is moving from projections and models to increasingly common droughts, floods and rising seas. The scientific community has made it clear that achieving net zero emissions by 2050 is critical to avoiding some of the worst effects of climate change, but we now face what the UN Secretary-General calls “a code red for humanity”. As Figure 1 (below) indicates, we are also over-running planetary boundaries across a range of other domains and increasingly witnessing a host of environmental indicators moving in the wrong direction, such as on forests, oceans and species diversity. ESG explicitly connects corporate action and strategy to these urgent global challenges, and expands the conversation about who is responsible and how we will respond.

The second factor is that the pressures to act are coming from all sides. Countries and companies are committing to carbon reduction, often in the form of a net zero commitment. However, 2050 is a long way off, and many parties have not adequately planned out a realistic pathway to achieve that goal – yet the potential impacts are likely to be felt much sooner. ESG offers the possibility of holding companies to their promises, enabling critical evaluating of their efforts in real time.

Third, ESG may also enable society to better anticipate and respond to large-scale disruption. Covid-19 has exposed profound gaps and vulnerabilities around the world in our infrastructure and our societies. The global pandemic demonstrated just how damaging unexpected events can be to the global economy and to societal health and wellbeing. Its shocks have disrupted global supply chains, healthcare systems and economic growth, plunging millions back into extreme poverty. ESG requires companies to pressure-test their business models under these kinds of scenarios and encourages them to invest in more resilient ways of operating. In short, ESG gives us a roadmap to confront these challenges as we prepare for an uncertain future.

ESG and its discontents

Let me be clear – ESG in its current form is no panacea. Just as ESG enters the lexicon of every business leader, a backlash is emerging with equal speed and ferocity. Criticism is coming from environmental and social advocates who question whether ESG actually improves societal outcomes, or just reduces corporate exposure to risk.

Do ESG measures and funds actually help us achieve the UN Sustainable Development Goals, or are they just another way of protecting shareholder interests?

Widely divergent ESG ratings of the same companies have also increased skepticism about the overall effort. Controversially, Tesla was removed from ESG funds while oil and gas companies remained. Even investors who previously championed ESG have now challenged the profound flaws in current ESG measurement and evaluation systems (see, for example, Kathryn Dunn, ‘Does ESG investing actually make a difference?’, Fortune.com, August 2021). If ESG is to maintain credibility, we have a lot of work to do.

Different parts of the world also appear to be headed in different directions. For example, in April 2021, the EU released a Corporate Sustainability Reporting Directive (CSRD) that mandates rigorous disclosure standards, enhances coverage, and improves the reliability of sustainability reporting. While there are similar government efforts to create standards in the US, there is also a lot of controversy about the use of these standards. Florida’s Republican government, for instance, has banned the use of social, political or ideological factors in the state’s pension fund investment decisions. Many other Republican-led states are pursuing similar restrictions.

Asset managers are challenging this political attack on ‘woke companies’, arguing that considering ESG factors should actually increase returns over the long-term. ESG is not altruism or progressive politics in disguise, but rather, a useful tool for cool-headed risk management.

Properly understood, ESG holds the promise of redirecting capital and using investor leverage, but it is only one part of a larger project of creating a more sustainable economy. We shouldn’t lose sight of that more ambitious mission, oversell its immediate impact, or let it become bogged down in culture wars.

Four ‘no regrets’ strategies

This uncertain moment raises many complicated questions for business leaders, but there are a few ‘no regrets’ strategies that should be on every leader’s priority list.

1 Root your ESG strategy in purpose and core values

Rather than trying to appeal to the rapidly shifting interests of the loudest stakeholders, root your ESG strategy in your purpose and core values. A good example of this is Dick’s Sporting Goods, a US sporting goods retailer. In the wake of the mass shooting at a Florida high school in 2019, Ed Stack, the chief executive of Dick’s Sporting Goods, made a risky decision to restrict gun sales.

The move created an immediate backlash. But rather than reversing course, Stack doubled down on the company’s position, explaining that it was anchored in the company’s core values and purpose. This commitment enabled the company to weather the criticisms and stay true to its values. Ultimately, the business thrived, increasing net sales by over 40% between 2019 and 2021.

2 Operate at speed and scale of the challenge

The second ‘no regrets’ strategy is to operate at the speed and scale of the challenge. Given the urgency of climate change and other ESG themes, there is no time for incrementalism.

One company that demonstrates this urgency well is Trane Technologies, which focuses on heating, ventilation, air conditioning and refrigeration systems. In 2020, Trane announced its Gigaton Challenge – a commitment to eliminate a gigaton of carbon emissions from its customers’ footprints by 2030. This is hugely ambitious, equating to about 2% of the world’s annual emissions. Decarbonization is not just another requirement for Trane: it is now embedded in the company’s core business strategy.

Based on this commitment, the company is now a highly valued ESG stock with a suite of powerful technologies for decarbonization, food waste reduction, and climate-friendly refrigerants. Thinking at the scale of the climate challenge has enabled Trane to define a distinctive and profitable niche in a rapidly evolving global market.

3 Ensure a just transition while achieving net zero

The third strategy links global efforts to decarbonize with the imperative to make the world a more equitable place. In Denmark, since the 1970s, a coalition of employers, unions and the government have converged around an industrial policy aimed at energy independence and low carbon energy. With a skilled workforce and manufacturing base developed through its historic strength in the shipbuilding industry, Denmark has been able to scale for a globally competitive wind industry. Its ambitious industrial policy has enabled the country to shift its energy mix to displace coal – over 40% of its energy now comes from renewables – while creating tens of thousands of new jobs and gaining global recognition as a leader in clean energy. Denmark’s early commitment to clean energy has driven the growth of two powerhouse global companies – Vestas, the world’s second largest wind turbine manufacturer, and Ørsted, the world’s largest offshore wind company.

A long-term vision and firm commitment to build a better energy system has paid off for Denmark’s citizens, the global climate and the national economy.

4 Be a good ancestor

While the ESG discussion is often highly technical, I think many people are interested in this topic because they care about the state of the world and how they will leave it for their kids and grandkids. It is good to be skeptical of the high-minded rhetoric of executives who proclaim their commitment to making the world a better place, particularly if they are undermining those efforts behind the scenes through their lobbying efforts. We need to make sure that our leaders walk the talk, and ESG may give us more leverage to hold companies accountable.

However, beyond the vital efforts to design measures and standards, we also need a new mindset that is oriented to the long-term consequences of our actions. We have been socialized in an economic system where billions of dollars can be transacted in fractions of seconds, so we are unaccustomed to thinking about time horizons of decades or even longer. Yet there are fascinating examples of societies that have embedded accountability toward future generations in their institutions, as Roman Krznaric explains in his book, The Good Ancestor.

For example, Japan’s Future Design movement has established a creative approach to towns’ citizen assemblies. Half of the group is assigned to represent current community interests, while the other half don ceremonial robes and imagine themselves as residents of the town in 2060. Intriguingly, this future group often demonstrates an ability to imagine much more transformative plans for making the town better.

Engaging as a representative of future generations can enable us to see past short-term distractions and focus on actions that create long-term value.

Perhaps the real value of ESG is that it creates a window of opportunity to bring fresh insights into the everyday work of running our organizations. We don’t need to predict the future and we can’t hide behind a veil of secrecy. If we pay close attention to the emerging signals, we can get better at recognizing the outlines of what is coming and do a better job of navigating it. As the science fiction writer William Gibson reminds us, “the future is here – it’s just not evenly distributed”.