It’s time to let go of legacy practices.

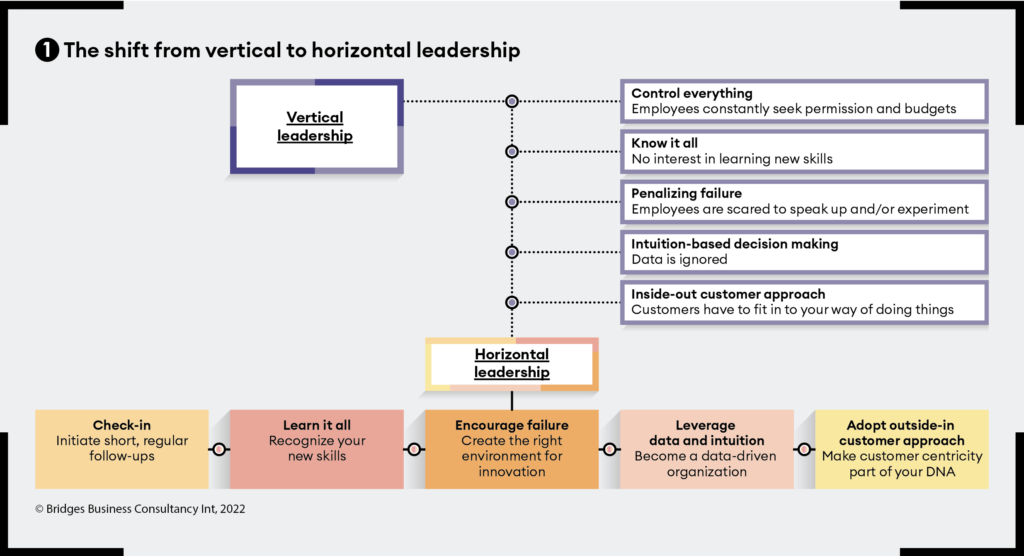

The way you led your organization yesterday does not work for today. Leaders need to change to meet the demands of new business models in a digital world. This involves moving from vertical to horizontal leadership: from giving permission for changes, allocating funding and managing through meetings, to managing through the agile approach, customer journeys and leveraging data.

This insight emerged from our client work and more than 200 hours of structured interviews at two industry-leading organizations in Singapore: the German semiconductor manufacturer Infineon Technologies, and DBS Bank, named the world’s best bank for the last five years in a row. Both businesses have recognized that organizational leadership in a digital world demands a shift in perspective and leadership style.

Infineon’s transformation centers on its Arise program: a three-year, US$20 million initiative to establish a global AI innovation hub by 2023. It is driving the initiative both internally, with employee training for the growth (digital) mindset, and externally, working with Singapore’s strong AI ecosystem. At DBS, the digital transformation story began in 2014, when the bank recognized that it needed to change to survive. Too many customers found banking painful; from this insight was born the strategy of ‘Making Banking Joyful’. Leveraging new technologies could help make banking invisible and create enjoyable banking experiences for customers.

Our research across these two innovative businesses has revealed the shifts that every digitally savvy leader needs to address in a changing landscape.

New customer expectations demand a different leadership approach

Organizations need to be more responsive than ever to their changing customer requirements in a rapidly shifting business landscape. One of the top reasons organizations fail to implement their strategies in a digital world is leaders not letting go of legacy practices. Employees are often excited by the opportunities created by digital – witness, for example, the energy displayed in hackathons and design-thinking sessions – yet they are left frustrated when mismatched leadership practices create bureaucratic bottlenecks.

Cross-functional teams are best-placed to deliver differentiated customer experience and business outcomes.

Both Infineon and DBS’s leadership have learned that to transform their businesses in a digital word they must transform their leadership practices. In DBS, for example, they have created the term ‘managing through journeys’. They are focused on mapping customer journeys across the whole business and leveraging data to create better customer experiences. As the bank’s chief executive Piyush Gupta explains: “Given that journeys are by definition horizontal, silo-breaking cross-functional teams are best-placed to deliver differentiated customer experience and business outcomes. The horizontal organization formalizes the collaboration and joint accountability needed to maximize end-to-end customer and business outcomes.”

Infineon presents an alternate approach. Rather than centering on the journey, it challenges leaders to adopt a growth (digital) mindset. Leaders embrace a multi-lateral and trust-based approach. The mindset model guides leaders to empower people to run more experiments, broaden their approaches to critical and analytical thinking, self-initiate their own learning, and collaborate. For Infineon, mindset growth happens best when leaders adopt a horizontal approach.

What then can leaders do to initiate the transition? We have identified five critical horizontal leadership shifts.

Shift #1 From controlling everything to checking-in

Leaders are used to walking into meetings and being the first to talk, running the agenda, delegating responsibility, and generally being in control. Those days are fast disappearing. Leaders now need to be the last to talk in meetings, so they can hear what is going on and listen as employees share their transformation activities.

Previously, after identifying key insights, employees would need to spend time securing approvals and budgets from various committees, through bureaucratic and top-down processes. In a digital world, organizations need to respond faster to changing customer requirements; thus, employees have increased autonomy and can focus their time on creating improved customer experiences. This means the leader’s role has shifted from command-and-control to guiding-and-supporting – so they need to check-in regularly to find out what is happening. With employees increasingly working cross-functionally, it is also critical for leaders to view the business end-to-end, and not just vertically, within their area of responsibility.

At DBS, Piyush Gupta told us that while he used to go to meetings to tell people what to do, he now goes to listen – to discover what is happening in the bank! In the early stage of its digital transformation, DBS identified meetings as the biggest culture barrier to its success. They established new rules for meeting governance, including a strict discipline of starting and ending on time, having a fixed agenda, and including everyone in the discussion. This eliminated 500,000 employee hours that were being wasted in non-value adding meetings, freeing people to do the valuable work of making banking joyful for the customer. (The bank’s meeting governance is freely available in its ‘MeetingMojo’ app.)

Action: Let go and become accustomed to not being in control; adopt a role which involves more listening guiding and coaching by regularly holding employees accountable with frequent check-ins.

Shift #2 From know it all to learn it all

Leaders have been accustomed to often being the most knowledgeable person in the room: indeed, it is part of why many were promoted. This, again, is no longer the case, since some of today’s key skills and knowledge are relatively new. Writing code, analyzing data and adopting horizontal leadership, for example, have not traditionally been part of a business school’s curriculum. Leaders and employees need to go back to school.

This may literally require time in a classroom, but it includes much more. Self-initiated learning – listening to talks, reading articles, or participating in digital activities – is essential. Reverse mentoring, where a learning relationship is led by younger or more junior employees, is also becoming very popular.

At Infineon, reverse mentoring accelerated the adoption of a new platform that promised substantial process improvements via digitized documents, streamlined data access, greater transparency and better decision-making. Despite its promise, persuading senior leaders to use the new system was not easy. Junior employees stepped up and guided senior leaders through the process via one-on-one sessions. Our interviews revealed numerous similar examples where learning flowed upwards in the organization.

Action: Recognize the new skills and knowledge required in business today and have an open mind to learning.

Shift #3 From penalizing mistakes to encouraging failures

To transform your organization in a digital world, employees need to experiment and find ways to enhance the customer experience. They must fail at times. Failure is a good thing and needs to be encouraged, because to innovate you must experiment, and when experimenting you need to fail. Otherwise, you’re not pushing the envelope of what’s possible to improve the customer experience. Also, many of these experiments will be cross-functional, reinforcing the need for leaders to shift their perspective and leadership style.

What is crucial is that organizations learn from failures and ‘learn fast, learn forward.’ Leaders are responsible for creating the organizational climate for this to happen, so that employees feel safe to experiment. In the past, many organizations had a low tolerance for mistakes – not least in banking and semiconductors – primarily because they translated to costs. But once a transformation in a digital world begins, leaders need to encourage failure, within a culture of psychological safety.

As Harvard professor Amy Edmondson, a leading authority in psychological safety, has said, “In today’s world, we need to take interpersonal risks to do good work.” The four domains of psychological safety that she identifies in The Fearless Organization are critically important. First, open conversation: are employees transparent with one another, and holding important discussions in an open space? Second, inclusion and diversity: do people feel comfortable speaking up and sharing different opinions? Third, willingness to help: do people avoid the blame game and instead make the effort to assist colleagues? And fourth, attitudes to risk and failure: is failure seen as an opportunity to learn about what doesn’t work, and to improve and grow?

At Infineon, psychological safety has been encouraged by formalizing how teams can think about experiments, at three different levels. ‘Autobahn’ experiments are performed many times; they are easy and straightforward. ‘Mission’ experiments address mid-level complexities, with some uncertainties: they need non-conventional solutions. ‘Expeditions’ tackle high complexities, high levels of uncertainty and unknown approaches. In a business that traditionally strived for zero defects, leaders have recognized the need to create a culture that allows employees to deal with perceived risks and uncertainties.

At DBS, leaders created a ‘Dare to Fail’ award for experimentation. Giving positive recognition to those who experimented but did not succeed, it is showcased by Piyush Gupta in town halls to encourage the right behaviors. Thousands of experiments now take part across the bank every year and employees have been spurred to pursue innovative ideas in a safe environment.

Action: Acknowledge that to innovate we need to experiment, and when experimenting we need to fail; and that failures are learning opportunities that lead to enhance customer experiences.

Shift #4 From intuition to data and intuition

“Better data, better decisions,” is the new organizational mantra. Everything that happens in an organization can be measured, and data must be made accessible across departments rather than being held in silos.

For this to happen the organization is first required to clean up its legacy data. This leads to the development of a data-first culture and stronger data capabilities, and the establishment of a fit-for-purpose data platform that enables scalability and continued security. Leaders are responsible for putting in place the governance and support for data use, and identifying who has access to which data. This is the easy part: the greater challenge is getting employees to start using data in their decision-making. Leaders achieve this by encouraging employees to focus on the problems they are solving, rather than what data they use.

In one example, DBS used data to reduce turnover among its relationship managers (RMs). It identified a raft of data relating to RMs that was not being used, including the timing of their first sick day, the number of days’ training they had, their branch’s location, their monthly revenue and their leave patterns: in total there were 600 data points. The analytics team and HR used machine learning and found they could predict with 85% accuracy which RMs were likely to leave the bank within three months. This model now creates a monthly report – a digital nudge – that alerts supervisors about potential resignations and prescribes steps they can proactively take. DBS now retains more than 90% of the employees who might otherwise have left – and for every 1% reduction in turnover, the bank saves about US$3.6 million. Action Don’t give ‘data lip service’: insist on using data across the organization, combined with intuition, to make better decisions.

Shift #5 From inside-out to outside-in customer perspective

For too long, many organizations designed their business models predominantly around what works best for the business and then forced customers into that way of operating. When transforming in a digital world, however, an outside-in, customer-centric approach is not just important, but fundamental to success.

Leaders can achieve this perspective by ensuring the right question is being asked. Instead of asking, “What works best for us?”, ask, “What works best for the customer?” Such reframing drives everyone to think differently – to work horizontally. Tools such as design thinking, hackathons and customer journey mapping enable the shift to a customer centric culture.

DBS adopted the UK Design Council’s Double Diamond framework for design thinking. It helped the bank gather and synthesize insights and inspiration from its customers, with employees focusing on customer data and becoming more engaged with other departments and stakeholders in customers’ journeys. The resulting collaborations broke down traditional silos and enabled employees to become customer obsessed, rather than internally obsessed.

Action: Don’t ask what works best for us, but what works best for our customers – and then design from the outside-in.

Two essential leadership ingredients tips

There are two crucial ingredients for navigating the shift from vertical to horizontal leadership. The first is acting with humility, setting ego aside and giving unfamiliar approaches a go. Leaders need to be open to new approaches.

The second: change behaviors first, and mindset change will follow. Our interviews revealed how leaders sensed the need for a different leadership style and set about implementing it by changing their own personal behaviors. A leader’s orientation needs to trend towards action to keep the focus on customers and data, and to maintain forward progress.

The best piece of advice we can share with leaders who wish to respond to these five shifts is: act now, learn fast, and repeat. Excel at transitions and then help others to excel with you.

Robin Speculand is CEO of Bridges Business Consultancy Int, a Duke CE adjunct faculty member and author of World’s Best Bank. Michael Netzley is founder of Extend My Runway, an AI-for-good start-up offering strategies for optimizing an age-inclusive workforce.