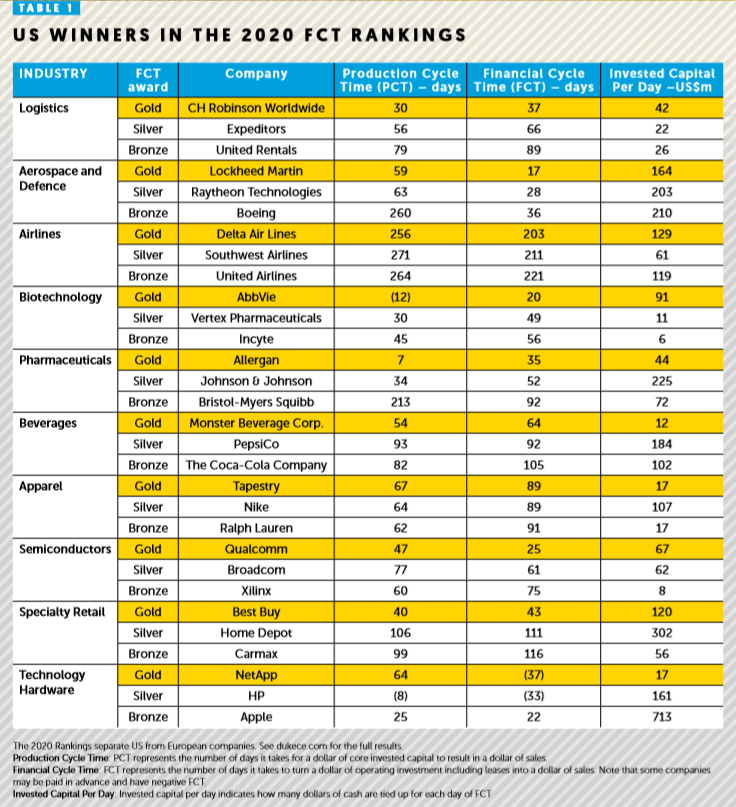

In the wake of the coronavirus pandemic, as the global economy plunges deeper into recession, it is perhaps more important than ever that companies cut costs, boost efficiency, and increase the speed to revenue from investments. Only those companies who can turn a profit quickly from new investments will survive in this challenging time. Financial Cycle Time (FCT) measures just that — the average time it takes a company to turn an investment into revenue. The metric is measured in days — the fewer days it takes to realize a profit, the better. In short, more productive and efficient companies win.

Financial Cycle Time =

Invested Capital

_____________

Sales

x

365

Examining the Financial Cycle Time of the world’s most agile companies can reveal lessons about how they maximize profit and productivity using minimal resources. For the third consecutive year, we looked at more than 1,000 publicly-traded companies around the world to determine the companies that are most financially agile and resilient.

Download Financial Cycle Time Rankings 2020

To benchmark your organization’s financial agility against the best in the world,

download the rankings table.

What this ranking means for you

In order for your company to win, you need to be doing everything faster and with fewer resources. Here are two essential questions for your leadership team:

- What could you do in less time?

Are there ways to increase the speed of every company activity and decision? The challenge is to identify ways to improve speed without compromising safety, quality or performance.

- What could you accomplish with fewer resources?

It may sound counterintuitive, but you’re in a stronger competitive position with fewer resources. That’s because you become more efficient in the process.