The speed a business moves can be a critical source of competitive advantage. Here are the winners from the latest research on financial cycle time in the US and Europe.

In 1972, upstart Southwest Airlines was facing an existential crisis. It was swimming in a sea of red ink and was down to just $143 in its corporate checking account. The airline was flying four 737s to three Texas cities – Dallas, Houston and San Antonio. Its leadership made a desperate gamble to stay afloat. They calculated that if they could get the turn-around time down to 10 minutes, it could maintain its schedule with three planes rather than four. Southwest decided to sell its fourth plane for $500,000 in cash, and convinced its employees that the 10-minute turnaround target was do-or-die for the company.

The company’s vice president of operations was a seasoned industry veteran named Bill Franklin. When he was asked at the time whether the company could pull off its audacious plan, his answer was simple: “We can and we will.”

Franklin’s team consisted of mostly non-industry veterans who believed in the mission to get it done to save the company. Identifying over 100 tasks that needed to be completed for a plane to depart, the airline studied professional car racing for inspiration, searching for the precious minutes and seconds that could be shaved off every task. All members of the airline, from its founder Herb Kelleher to the pilots to the gate agents, were enlisted to do the tasks found necessary to achieve the goal.

Southwest survived – and the policies it instituted, starting in 1973, continue to allow Southwest to have an efficiency advantage through to today: the airline takes Gold in the 2023 Financial Cycle Time (FCT) rankings, presented here (see tables).

Cutting turn-around time

Today, Southwest Airlines typically has an average turnaround time of 35 minutes or less, for a flight: that is, the time it takes to unload and load passengers and baggage. This is considerably shorter than the industry average of 45 minutes. This advantage allows Southwest to fly the same type of plane for between one and three additional segments per day compared to a traditional airline. In short, it gets greater use from one of its most important assets, its planes. Here’s how.

Single aircraft type

Operating primarily Boeing 737s simplifies maintenance, training and turnaround processes. It also allows its flight crews to easily switch between aircraft. This would not be possible at other airlines that operate Boeing 737s and Airbus A321s simultaneously.

Point-to-point routing

This strategy reduces the complexities associated with hub-and-spoke systems, allowing for quicker gate turnarounds.

Flying to less-crowded airports

Southwest began its expansion at secondary airports in the larger cities, and continues to fly to mid-size cities with less congestion. (However, other airlines are now copying this strategy to reduce their own turn-around times, while Southwest has been expanding into larger cities with more congested hubs. Its hub in Philadelphia has some of the worst delays in the US. This has mitigated some of Southwest’s advantages.)

Team coordination

Inspired by Nascar pit crews, Southwest’s ground operations are highly coordinated, with tasks clearly delineated and timed to precision. This not only speeds up the turnaround but also ensures safety and thoroughness.

No assigned seating

The lack of assigned seating speeds up boarding of the airplane. It incentivizes passengers to get to their seats quickly, lest they end up with an undesirable seat.

Role of the flight crew

Flight attendants assist in cleaning a plane while passengers

are disembarking.

Cultural impact

Rapid turnaround times are not just about logistics and operations: they also reflect Southwest’s company culture, which emphasizes teamwork, high employee engagement, and a sense of urgency. This culture is facilitated by leadership that motivates and supports staff in achieving these ambitious turnaround goals.

Free checked baggage

When other airlines started charging baggage fees, Southwest continued to offer free checked-in baggage. On other airlines, rather than paying the fees, passengers increasingly took their carry-ons on board, slowing down the boarding process.

Southwest continues to innovate its turnaround processes. For instance, they have tested new technologies, such as handheld baggage scanners and mobile gate readers to further reduce turnaround times. The airline also holds workshops to ensure all team members understand their roles during the turnaround process, fostering a deeper sense of teamwork and efficiency.

Competitive advantage and trade-offs

Its strategy has provided Southwest with significant competitive advantages. Reducing ground time maximizes flying time, which translates to better asset utilization and cost efficiencies. These savings allow Southwest to maintain low fares, attracting more customers and gaining a significant market share despite competitive pressures.

Southwest Airlines’ ability to maintain short turnaround times has been a cornerstone of its business model, allowing it to remain profitable and competitive in a challenging industry. Its success is built not only upon operational efficiencies and technological innovations, but a strong organizational culture that supports and drives these processes.

Time is money: calculating FCT

Why do profitable companies borrow money? If they generate more revenue than expenses, one might think that they shouldn’t need to borrow any money. But that isn’t the way things work. They have to spend money before they get paid, they need to fund the timing gap between when they spend the money and when they get paid. The longer the timing gap, the more financing is required. This timing gap is the financial cycle time.

This metric can reveal substantial differences between otherwise similar-looking businesses. Imagine two companies in the same industry with very similar market focuses and financials. They both generate a profit margin of 8%. But the first company makes that margin every 365 days, compared to the second company’s cycle time of 183 days. Annually, that translates to 16 cents of cash for investors, compared with eight cents of cash for the slower company. The more productive and efficient company wins financially and will have a higher return on investment (ROI).

The algorithm that we have developed for measuring FCT using companies’ financial statements helps to measure the speed at which a company’s business model operates. As long as quality or safety do not suffer, moving faster and more efficiently can be a boon to cash flow generation for a company, and can be a source of competitive advantage.

To estimate FCT, we start with the total investment in operating assets and liabilities for each company and divide by annual revenue. This gives the percentage of a year that it takes to sell the investment. Multiply by 365 and you get FCT time in days. Lower is faster. We also produce a second metric: production cycle time (PCT). This is produced by focusing on only working capital and net property, plant and equipment (PP&E). Divide by annual revenue then multiply by 365 to arrive at PCT.

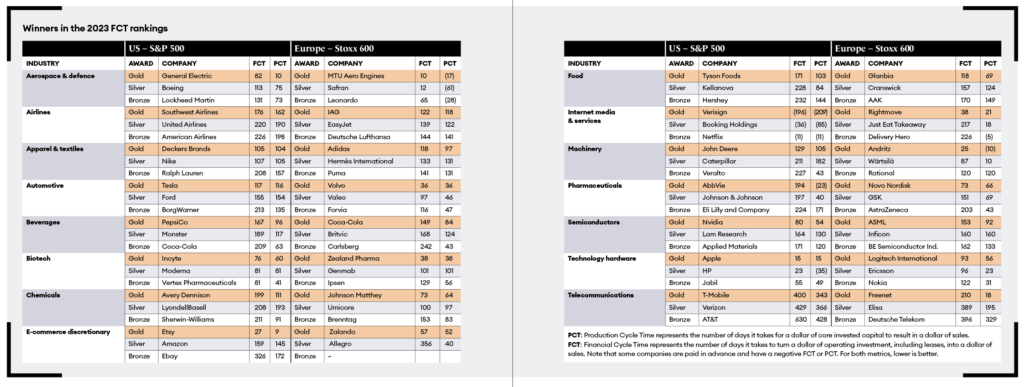

We applied this methodology to firms in the S&P 500 and the European Stoxx 600 to identify leaders of the FCT metric. The firms with the lowest FCT in each industry are awarded a gold medal for being the most efficient in their segment.

Going back to Southwest: its financial cycle time of 176 days in 2023 means that, on average, it took 176 days to turn a dollar of investment

into a dollar of collected cash. Each of those days tied up $124 million in cash. You can think of Southwest’s total financing to its business as: 176 days x $124 million per day = $21.8 billion of invested capital. Since Southwest is 44 days faster than its closest rival, it has saved $5.5 billion by being more efficient.

Apple is the winner in the technology hardware segment, based on its much-vaunted global supply chain, which was set up by Tim Cook to reduce its inventory. It achieved an FCT of just 15 days. Nvidia was the most productive semiconductor firm with an FCT of 80 days. Nike is a silver winner in the US for apparel with 107 day cycle time, while in Europe, Adidas leads the way with an FCT of 118 days. Novo Nordisk, the maker of weight-loss drug Ozempic, leads all global pharmaceutical firms with an FCT of 73 days. Tesla is the fastest North American automobile maker, with an FCT of 117 days, but Volvo takes the crown globally for that industry, with an FCT of just 36 days.

Leaders need to understand how fast their organization can move. Financial cycle time is one metric of speed that can give insight into this question. It can be a source of benchmarking against peers and allow for performance to be tracked over time. So, ask yourself: is your organization moving fast enough?