One of the traits of an elite athlete is speed. The very best out-pace their opponents, move across the field much faster, and react quicker than their peers. In 2021, the elite athletes of the corporate world are those who are more productive and efficient at making and selling their products and services. Their performance is recognized using a metric called Financial Cycle Time (FCT).

FCT measures how fast a company, on average, can turn investment into sales. It measures the ‘how often’ of a business. To understand its significance, consider an example from the retail sector. In 2020, Walmart made a pre-tax profit of 4.8% on sales, while competitor Costco, selling a similar product, made only 3.6%. Walmart is the clear leader when it comes to profitability between the two and makes more money when they sell their product. This is the ‘how much’ of business.

Yet this is only part of the picture. Walmart sells and gets paid 4.8 cents for a product every 88 days, while Costco makes 3.6 cents every 40 days. In the same 80-day period, Costco can complete two cycles while Walmart is yet to complete one. That difference becomes a competitive advantage. This is where speed matters.

The pandemic’s impact

The impact of the pandemic on business will be felt for some time. Many businesses have been hugely disrupted and many consumer behaviors have changed, sometimes radically. One major trend has been the accelerated shift to online. Companies that had a multi-year roadmap for online strategies compressed their plans into days and weeks in April and May 2020 as the world shut down.

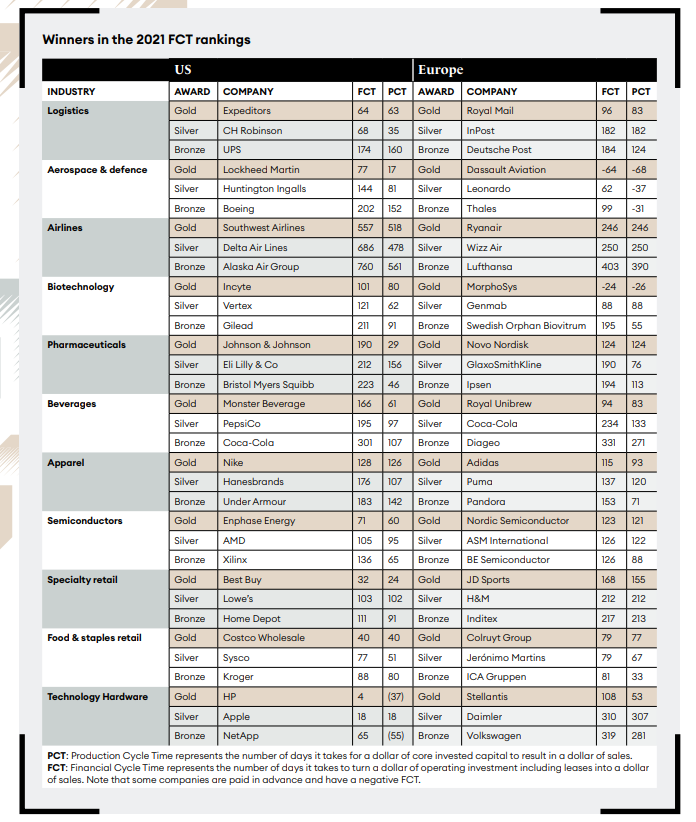

The most nimble companies have adapted well. In the US, FCT Gold Award-winning specialty retailer Best Buy suddenly had a new business model, with customers no longer allowed in their stores under tight Covid restrictions. They responded quickly with an omnichannel approach which combined e-commerce with ‘drive-up pickup’ collection from store sites. Their FCT of 32 days was best in class for retail in 2020.

Not every sector had the same options for adaptation. The travel industry suffered as governments issued ‘shelter in place’ or lockdown orders, and borders were closed. In the US, airline passenger volumes plunged by 70%. Many planes were parked in the desert with no places to fly. Southwest Airlines saw its FCT slow to 557 days as it scrambled for cash to meet short-term liquidity requirements – but its speed lessened the blow compared to peers such as American Airlines, which saw its cycle time slow to 760 days. European budget air carriers Ryanair and Wizz Air led their markets with cycle times of 246 and 250 days respectively.

Examining the Financial Cycle Time of the world’s most agile companies can reveal lessons about how they maximize profit and productivity using minimal resources. For the fourth consecutive year, we looked at more than 1,000 publicly-traded companies around the world to determine the companies that are most financially agile and resilient.

Improving FCT

Have you ever been in an inefficient meeting? What was the cost of that meeting? Take the number of people, multiply by their hourly pay and then multiply by the time of the meeting in hours. Then consider the sheer volume of meetings. Inefficient meetings can be looked at as a very large investment that add time to a process.

To improve cycle time, a company should focus as much on working smarter as it does on working harder. Eliminate the white space between decisions. Reduce redundancies within the system. Remove bottlenecks from processes. It is the perspective of the agile organization.

There are limits, of course. Some companies can move too fast. Improving FCT is not a license to cut corners, compromise safety or quality, or to be reckless. Speed can be dangerous. That is arguably the cautionary tale of Bronze award winner Boeing and the challenges it has faced over recent years with its 737 Max investments. Boeing was widely seen as being under pressure from rival Airbus to speed up its delivery of a next generation plane – and after an accelerated development schedule, the 737 Max experienced numerous design and safety challenges.

Companies need to focus on working smarter. If they can sustainably deliver their processes with quality and reliability, faster than their peers, it can be a source of competitive advantage.

— Joe Perfetti teaches equity analysis at the University of Maryland and is an innovation fellow with Duke Corporate Education. Joe is a professor in Duke CE’s online courses on Building Financial Acumen and Building Strategic Agility. You can view the 2020 Financial Cycle Time rankings here.