The industrial sector faces seismic shifts as digital technology grows ever more powerful. Now is the time to unlock value with data and AI.

The narrative of digital technologies reshaping industries is not new. Since the advent of internet browsers, online platforms and smartphones, digital innovations have revolutionized many sectors. Digital-first enterprises have outpaced traditional leaders who underestimated the impact of digital technologies. Until now, the transformation has primarily influenced sectors characterized by low physical asset intensity and high information dependency, affecting roughly 25% of global GDP. The remaining $75 trillion global economy, representing the more asset-intensive sectors, has seen limited impact. That’s poised to change.

We will witness a strategic reshuffle in the industrial domains, driven by data analytics and artificial intelligence (AI), including generative AI. Today’s industrial sector leaders must prioritize digital strategies at the helm of their agendas.

The digital challenge to industrial businesses

It isn’t like industrial enterprises have ignored digital technology – but they have yet to experience the seismic shifts that digitalization brought to industries like photography, music, telecommunications, financial services and entertainment, where digital renditions replaced physical products. Industrial giants such as GM (automotive), Deere (farming), and Caterpillar (construction) have excelled in creating high-quality analog machinery, but now face the challenge of transitioning to digital-driven business models where their products must become digital-industrial. Industrial giants have experiences with digital technologies that have redefined their processes with big enterprise systems (ERP) in areas such as supply chain management (SCM) and customer relationships (CRM). Adopting those technologies didn’t change the core of what they did, but the how.

The next turn of digitization, however, will impact the core of what these companies do – the product’s architecture. The emergence of digital natives, deeply versed in leveraging data and AI, poses a significant threat.

Tesla’s reinvention of the automobile as a cloud-connected supercomputer exemplifies how digital could have an extensive impact on industry structures, supply chains and value propositions. Suppose consumers shift their preferences away from owning an automobile to accessing transport as a service, provided by the likes of Uber, Lyft, Didi and Ola. In that case, it will reduce the demand for new private automobiles, but create new opportunities for shared vehicles and innovative new form factors. The shift from industrial combustion engines to hybrid and electric powertrains will reorder the portfolio of capabilities of automobile companies. Value will migrate towards entities controlling software and analytics rather than traditional manufacturing.

The architecture of an automobile is much closer to computing than the horseless carriage powered by industrial combustion engines introduced by Bertha Benz in the late 19th century. This architectural shift is more than just technological: it could shift the profit pools in extended ecosystems.

This transformation will not be limited to the automotive industry. For instance, John Deere’s initiative to develop tractors as “computers on wheels on farms”, capable of operating based on cloud-delivered instructions to distinguish plants from weeds, showcases the potential for digital integration in agriculture. In buildings and construction, Honeywell, Otis, Siemens, Hitachi and other industrial giants are analyzing how they could infuse their traditional offerings with digital functionality to create and capture new value beyond delivering the systems throughout the life cycle of operations.

Fusion forces and your datagraph

In our latest book, Fusion Strategy: How Real-time Data and AI Will Power the Industrial Future, we argue that industrial companies must adapt their strategies to recognize and respond to the ‘fusion forces’. These include blending physical and digital domains, merging human and machine capabilities, integrating digital logic into traditional engineering disciplines, connecting physical and virtual environments (e.g. through digital twins that have an end-to-end view), and fostering inter-company collaborations to form a network of competencies across industries. The ability to collectively harness these converging fusion forces will distinguish future leaders from those stuck in the old analog ways.

Let’s look at how digital companies disrupted asset-light, information-rich sectors. They developed multi-sided platforms with cross-subsidy (Google, Facebook), focused on the long tail of customer needs (Amazon, eBay), leveraged increasing returns to scale (Windows, Android, WhatsApp, Apple iOS), and offered ‘free services’ (search, email, social network and messaging) in return for access to personal data on individual behaviors. Many of those ideas do not readily apply to the industrial world – so we delved deeper.

One powerful idea emerged with profound applicability in industrial settings. Digital giants possess unprecedented data on how their consumers interact with them in real time. By collecting such data from customers, they amass data network effects. Using graph analytic techniques to decipher patterns across customers, each digital giant has constructed a unique datagraph. Google has its search graph, Spotify has its music graph, Netflix has its movie graph, Facebook has its social graph, LinkedIn has its professional graph, and Amazon has its purchase graph. Each is based on what they uniquely know about how their customers interact with them in real-time, every time. Their revenue and profits are intricately tied to their unique datagraph. This data is privileged and proprietary, unavailable to others.

Learning from such an approach, every company should ask: “What do we uniquely know about how our customers interact or use our products in real-time, and how are we leveraging them to deliver distinct value?” This is not static data, but data-in-motion; the differentiated analytics are not focused on descriptive and diagnostic, but predictive and prescriptive.

Could datagraphs drive strategies in the industrial world? Yes. The instrumentation of analog machines to transmit data at the point of use will shape the digitization of the industrial sectors. Powerful sensors are available at affordable prices to be designed into industrial products like cars, trucks, tractors, trailers and industrial equipment. When they are seamlessly connected to cloud functionality from companies such as AWS, Salesforce, Oracle, Google and Microsoft, industrial companies can now know their machines in use in more detail than ever possible. By analyzing such data across their diverse customer base, they can construct their unique datagraphs.

It doesn’t stop there. With their analytical prowess, including generative AI, they can go from description (what happened) to diagnosis (why did it happen), to prediction (what could happen) and prescription (what should be done). Digital giants showed the way in consumer sectors when they took advantage of the widespread adoption of smartphones. Industrial companies can now apply the ideas as the Internet of Things (IoT) and related technologies digitize the physical world.

Real-time data

What’s holding industrial companies back from making this leap? A major factor is that they have detailed high-quality data on machines designed and manufactured in multiple uncoordinated ‘systems of record’. They typically don’t have data on machines as deployed or in use, except aggregated data on machine failure that is unconnected to other databases. And without real-time data on how their machines operate in the field, they cannot construct their unique datagraphs.

A typical automaker, for example, has data about its cars as designed, manufactured and delivered – but not as driven. That data was impossible to collect until Tesla designed such data-collection functionality into the vehicle. Other automakers are catching up: Mercedes has embarked on a five-year roadmap to architect its cars as computers with an end-to-end view from the chip to the cloud, with internal investments focused on its operating systems, and partnering with Nvidia for computer chips. Armed with the scale, scope, and speed of data on machines as deployed, industrial companies can potentially unlock new value for customers and capture a fair share for themselves.

We call these actions fusion strategies, which combine what manufacturers do best – creating physical products – with what digital businesses do best: using AI to mine dynamic, ever-expanding, interconnected data sets for critical insights.

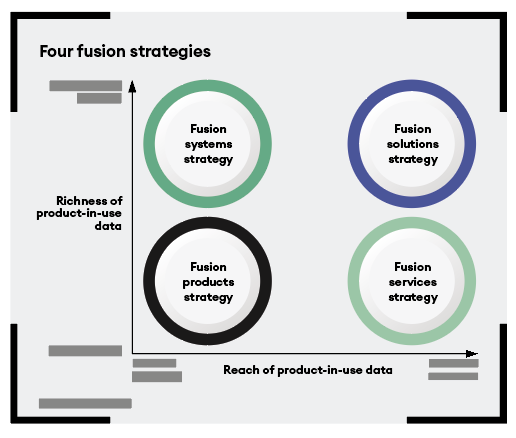

Four fusion strategies

There are four distinct fusion strategies relating to products, services, systems and solutions. Each strategy is defined by how industrial companies use the reach and richness of their datagraphs.

Fusion products When analog architecture is adapted with the capability to track and trace products in use, they become fusion products that can be monitored, maintained and upgraded remotely with software updates. Fusion products are not labeled ‘smart’ because they have digital displays and cellular connectivity; they are smart because they transmit valuable data on how they perform from different locations. The winner in the battle of brilliant machines is the one capable of deriving insights from data and insights from their far-flung network of machines.

Fusion services Industrial companies shouldn’t stop with fusion products. They should explore how to deliver differentiated services that directly impact customer profitability. By extending the reach of datagraphs to understand how their machines uniquely work in customer locations, fusion services aim to enhance customer profitability. Improving aircraft engines’ fuel efficiency by 1% in civil aviation could save $2 billion annually. Rolls-Royce’s R2 Data Labs saves its customers $200,000 per aircraft annually by analyzing the fuel consumption patterns revealed by product-in-use data, such as the routes that planes take, the altitudes and speeds at which they fly, weather conditions and the load carried. The winner in the battle to deliver remarkable results is the one who can fine-tune the machines to optimize customer profitability based on data network effects and powerful algorithms.

Fusion systems Industrial customers often use complex systems that include multiple machines and equipment made by specialized suppliers. Most customers manage these machines’ interoperability independently, but some hire systems integrators and consultants to install, connect and upgrade them. A fusion systems integrator must connect all the machines and equipment it has sold and interlink them with those of partners and competitors. Instead of being responsible just for interconnecting different elements and getting the system to work, as traditional systems integrators are, the creator of a fusion system must ensure that it improves continually as new parts are added.

The winner in the showdown of smart systems is the one best able to differentiate by leveraging datagraphs and AI. Most industrial companies are comfortable synthesizing structured data such as names, addresses, machines bought and parts serviced. But fusion systems leaders feed unstructured data – like images of defects, the sound of faulty machines, and video feeds – into generative AI in real-time to develop complex, realistic digital twins of systems. They then use those twins to experiment with mixing and matching different permutations of products, machines, components, and peripherals to determine which combination of technologies works best.

Fusion solutions The final strategy combines fusion products, services, and systems to improve a customer’s performance directly. Rather than developing solutions through traditional consultative sales processes that approach each customer problem as a one-off, companies develop them with insights from product-in-use data and design them to apply to many customers. However, creating these solutions effectively requires industrial companies to be experts at solving customer problems in ways no other company can. The winner in the clash of customized solutions would have earned an unusually high level of customers’ trust and tied their revenues and profits to customer success using outcome-based contracts and profit-sharing agreements (as they may eventually do with fusion systems).

The moment of opportunity

The industrial inflection point is now. The potential $75 trillion in the addressable market is too big for digital giants to ignore. Industrial leaders have now competed by developing proprietary technologies and integrating vertically. To execute fusion strategies, most must partner with digital natives and start-ups on new technologies and applications. They must focus beyond developing prototypes to designing pathways to scale up and be counted. This will require industrial CEOs to lead digital efforts – a responsibility they’ve usually delegated. Since digital and physical domains are inextricably fused, they have no choice except to lead from the front.

Vijay ‘VG’ Govindarajan is Coxe distinguished professor at Tuck School of Business, Dartmouth College. Venkat Venkatraman is David J McGrath Jr professor of management at the Questrom School of Business, Boston University. They are the authors of Fusion Strategy: How Real-Time Data and AI Will Power the Industrial Future.